Photography I Created

- Up has been seamless and worked (AUD->MXN) all the time at point of sale and ATM.

- My Australian-issued American Express has not worked (AUD->MXN) at point of sometimes.

- The Wise card has worked (MXN->MXN) at point of sale all but once, and I’m betting that was something at the gas station, as the card worked inside the gas station but not at the attendant’s EFTPOS machine on the forecourt.

- I transferred Mexican pesos from Wise to a Mexican bank account on a Sunday evening Mexico time and by the time I’d woken up I had received confirmation it had worked and the recipient had received the funds.

- I transferred Mexican pesos from Qantas Business Money to buy a car on Friday morning at 11am Los Cabos time and it’s just gone 1pm Monday morning and the money still hasn’t arrived to the recipient’s account.

- AirWallex support is operational 9-5 Monday to Friday Melbourne time. Even inside that time the phone number isn’t answered, and neither is the San Francisco office’s phone number answered. At this stage I am assuming the Airwallex and Qantas Business Money support team is a concrete block in the corner of the office.

- After doing business in a different country for a week I could not recommend against Qantas and Airwallex more. Do not use them if you want transfers to happen swiftly and wish to have support when things go wrong. I’ve had previous issues with the Qantas Travel Money built into the Qantas Frequent Flyer card, I don’t think anyone at Qantas has actually ever used these products abroad, so neither should you.

- After three days silence a Qantas Business Money staff member told me that they needed to check for fraud and safety which would be fine if this was communicated, but also they promised the transaction would take place as banks opened today and it has not.

- If you are happy with making withdrawals and payments at the going rate at the time, I recommend using Up.

- If you want to buy foreign currency and spend it abroad, use Wise.

- I’ve also had success swiping my ANZ Frequent Flyer Blank Visa card but I have only carried that as a backup.

- I haven’t tested all the Australian bank credit cards, I understand many of them are fine.

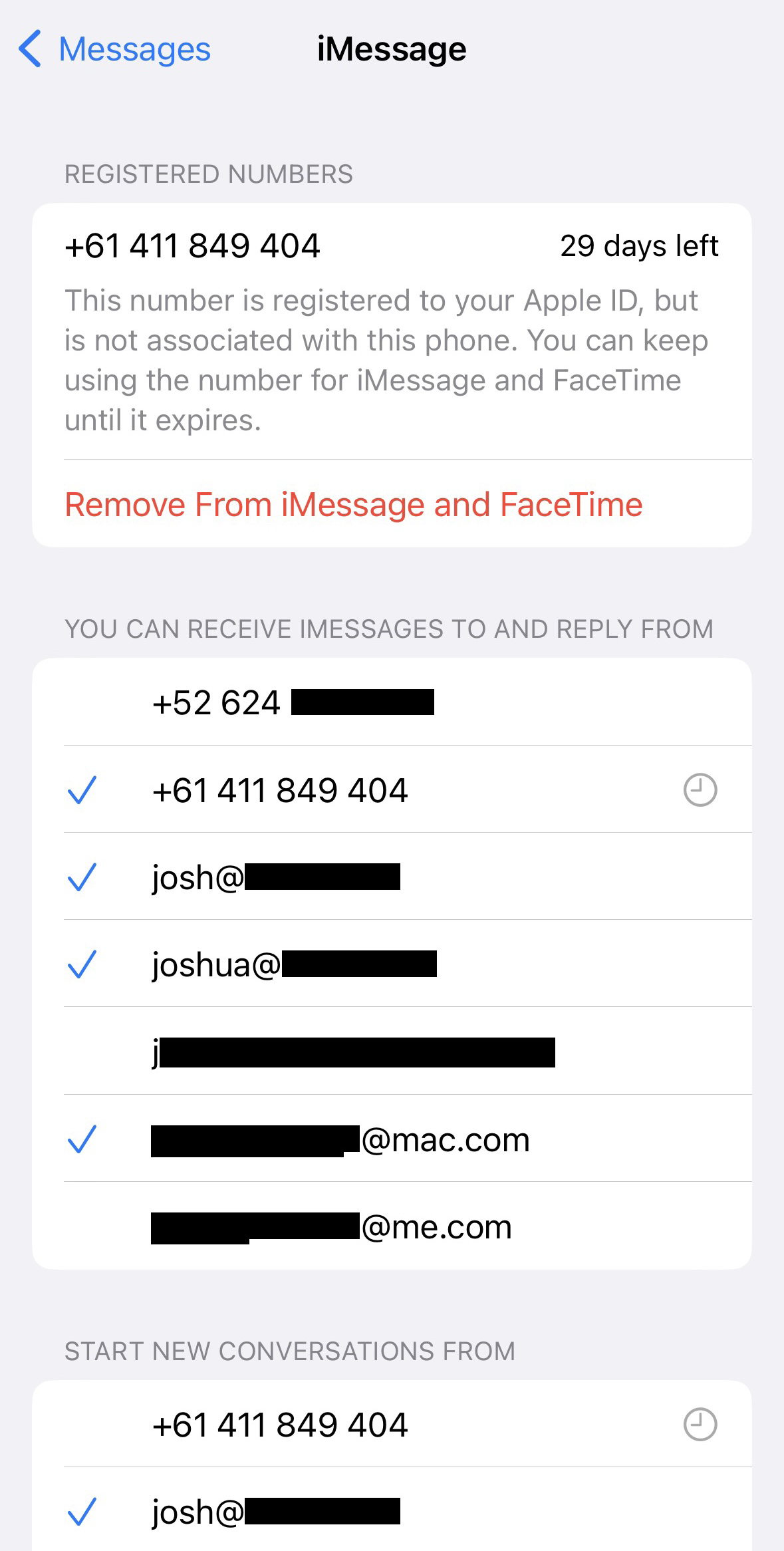

I’m reflecting on the recent Optus hack today as I wonder what to do with my phone number I’ve had for 20 odd years.

So much of modern society needs a phone number to work and to identify us.

New services register with a phone number and text message verification code, trusting that only you would have your phone number or SIM card.

When I turn off my Australian SIM card in Mexico iMessage warns me the clock has started.

It’s kind of ridiculous that something as fragile as a phone number is the backbone of identity.

I think do Dave Winer’s ten year old blog post proposing DNS as a form of ID, but I feel like that would exclude so many normies.

Funnily enough, in many parts of Mexico the police will take your number plate or drivers license back to the police station as that’s the closest the national identity systems don’t really exist here.

How are we supposed to verify who we are? Maybe a blue tick will help?

Just going on the record before November 2022 hits to say that I had a blue tick before it wasn’t cool.

That’s right, mum. I was verified before @tealou.

Is this mural on the toilet entry wall about menstruation?

The latest in dynamic bus signage technology

Someone just got a fire truck for their birthday or the truck celebrated its birthday. Either way, congrats!

Tequila shot $1USD

Thursday’s sunset

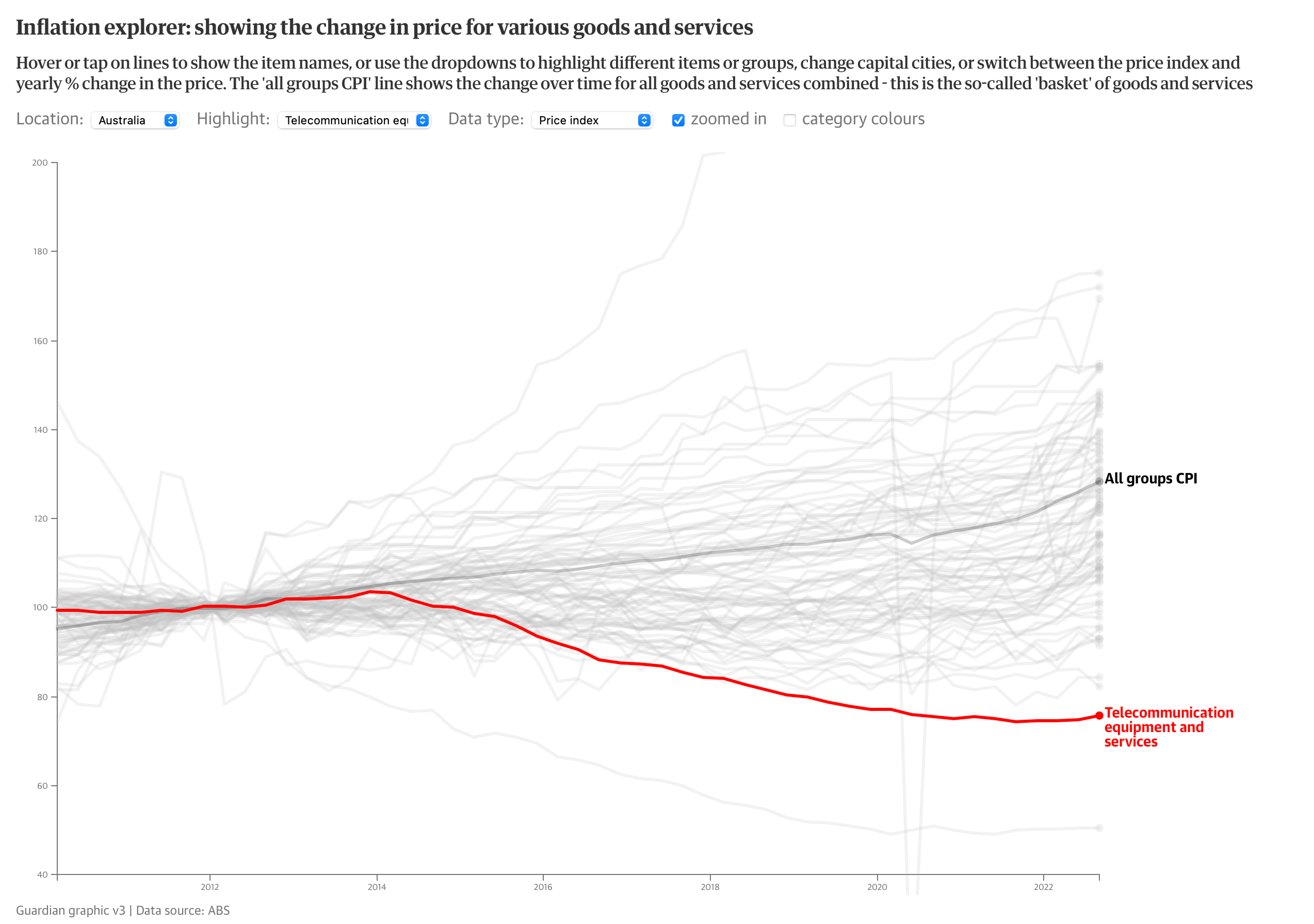

Good business sense tells me it’s time to sell all my beef, children, petrol, and non-essential oils, and buy more computers. Thanks for the revealing graphs, Nick Evershed at The Guardian

The moonrise over the Pacific Ocean was pretty cool tonight

It’s funny how the human brain likes little milestones and we call it “feeling real” … like just now how I put the finishing touches on a Wedding Officiant in Mexico page on my website, and enabled the Squarespace translation webpage feature.

Finally, it happened

I’m a sucker for 360 spherical images, but the places you can view them not-flattened are few. Lightroom online is one, so here’s the link for this one of El Pescadero at sunrise this morning: adobe.ly/3f55Fp3

Deporte bus

El Pescadero // home

Felt cute, might delete later

Hey, if you ever can’t get a hold of Jesus, lemme know, I’ll send you some Mexican Salvo, a sin remover.

My li’l mate, Luna, turns four today. She wants you all to know that she’s a big girl now.

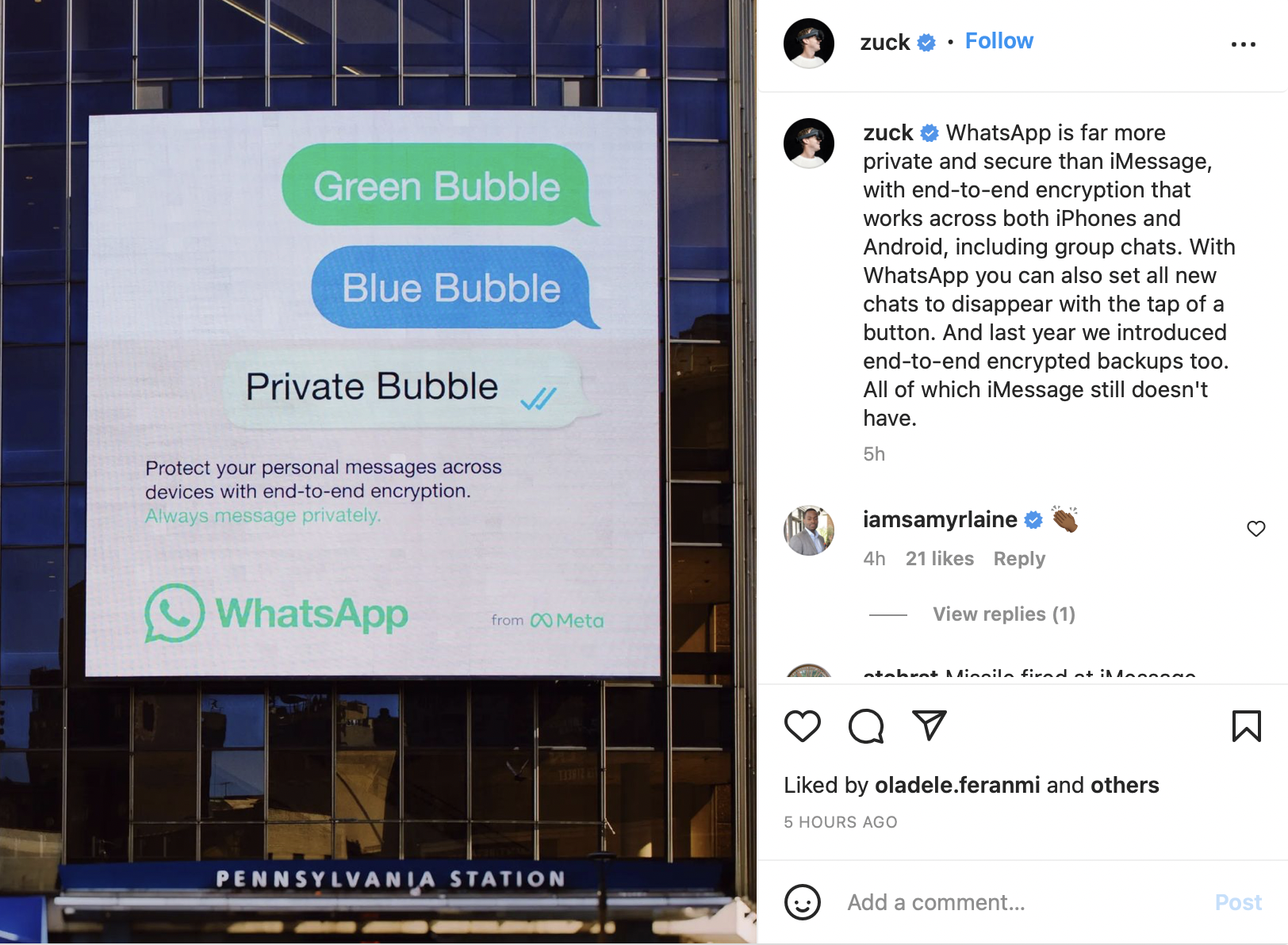

I can’t help but feel that Mark Zuckerberg is a bit off Apple at the moment.

As someone who uses WhatsApp because he’s forced to, not because he wants to, it’s an ugly app and I only get more message spam from Telegram. Every day there’s a new spam-women in my Whatsapp.

Travel money tips: Up Bank vs. Wise vs. Qantas Business Money (Airwallex)

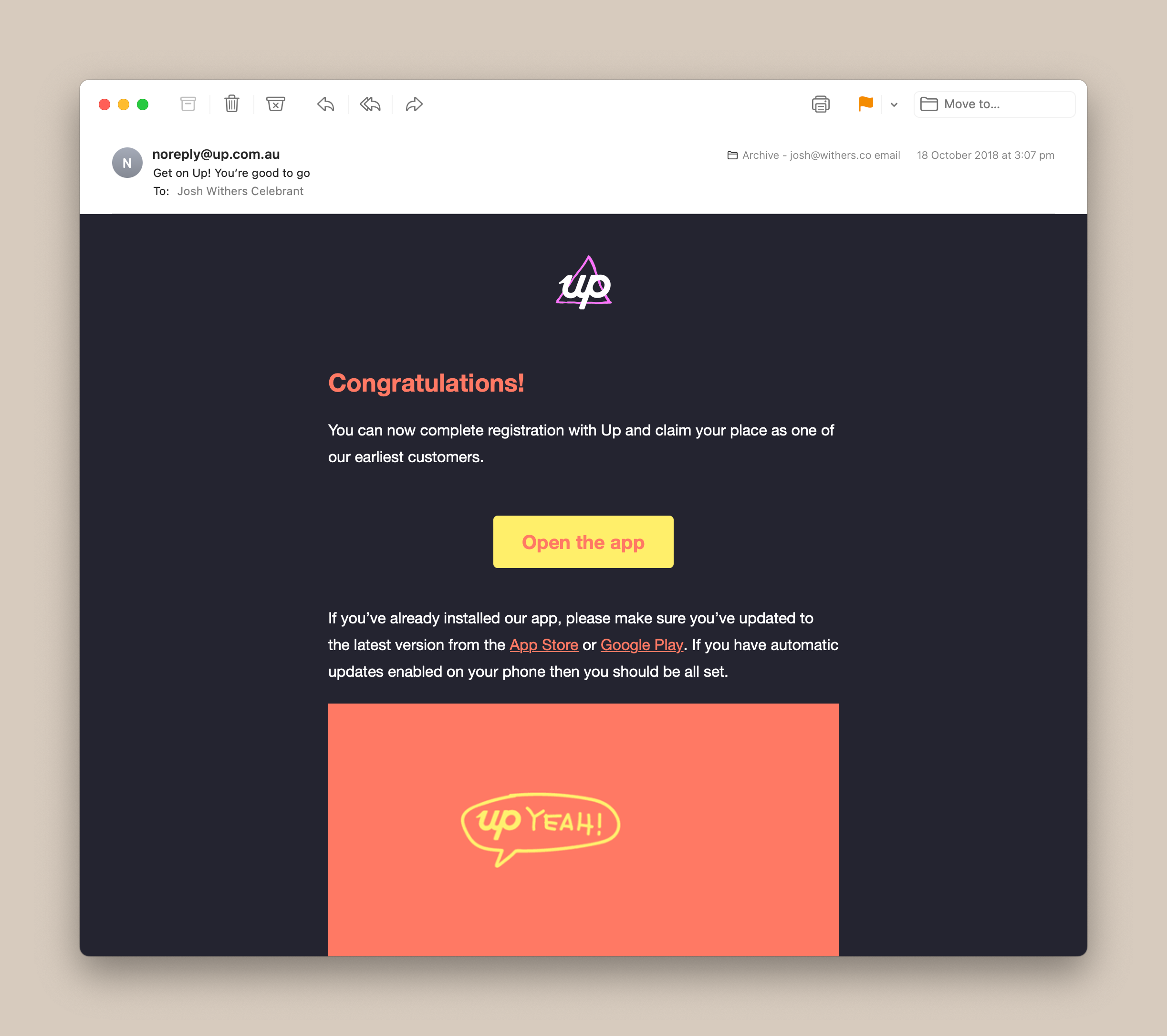

We’re in Mexico at the moment and I have thoughts on spending Australian money abroad. Four years ago today I became an Up Bank customer, and it’s one of the best things I’ve done.

The original sell was that if you had an Up debit Mastercard you could turn up at an international ATM or EFTPOS machine and swipe away without getting dodgy international fees. The payment would be made at the current rate, nothing dodgy or stupid. They lived up to that promise, and they still do today. Britt and I have moved all of our personal banking to Up and love everything about the bank, the app, the debit Mastercards, everything.

If you’re travelling overseas soon I could not recommend Up more. I started as an Up customer for international travel only, and after using the app more and more we became full-time customers.

The only thing Up couldn’t do inside itself was to purchase an international currency and spend that currency overseas. You might want to do this if you are travelling somewhere for a longer period of time than the week or two a holiday might be, like us moving to Mexico. (Side note: Up does have a current partnership with Wise, and I understand it’s just an easier way to transfer money to Wise.)

It looked like the Australian dollar would be going down on the Mexican peso over the next few months so I wanted to hedge against this and purchase some pesos. I have already used Wise (formerly Transferwise) for many international payments for our business, but hadn’t used the issued debit cards or used the international currency bank account feature yet.

Qantas had also launched a “business-grade” version of its Qantas Travel Money product called Qantas Business Money and they had big Qantas points offer available recently, so I took the opportunity to use both products. I moved a considerable amount of Australian Dollars to Qantas Business Money to help us purchase a car here, and then moved a similar amount to Wise for spending money. Qantas Business Money is a Qantas service provided by Airwallex, a Melbourne company with a handful of offices worldwide.

A few points on the three different travel money products.

Which banking products should you use?

Finally, you’re welcome to Google the products and do your own research, you really should, but if you sign up for Up using this link you get $5. If you sign up for Wise using this link you get a fee-free transfer of up to 500GBP and they pay me $90 for every three of you that signs up and transfers $300.

“This could be Heaven or this could be Hell”